Are you facing any of these problems of making tax invoices and receipts before sending to the Revenue Department?

Production cost of paper tax invoice

7 Baht per transaction

Delivery cost

20 Baht per transaction

Storage cost and seek for documents

20 Baht per transaction

Total cost per transaction = 47 baht per transaction

Deliver tax invoices to the Revenue Department, at the Thai Ministry of Finance on time by quickly and accurately generating e-invoices and e-receipts with e-Tax Solutions.

Organise, Digitise And File Your Taxes

Our e-Tax Solutions will help your organisation digitise your tax invoices and receipts, so that you can put the tedious process of the manual filing and sorting of tax documents firmly in the past.

Increase business efficiency by reducing the time needed for preparing and storing paper documents, as well as delivery costs with e-Tax Invoices, which can be sent via e-mail.

With e-Tax Solutions, you’ll be able to create files in XML format for submission to the Revenue Department and automatically deliver tax-related documents to your buyers or service recipients .

e-Tax Solution can create files in XML format for submission to the Revenue Department

and automatically deliver to buyer or service recipient .

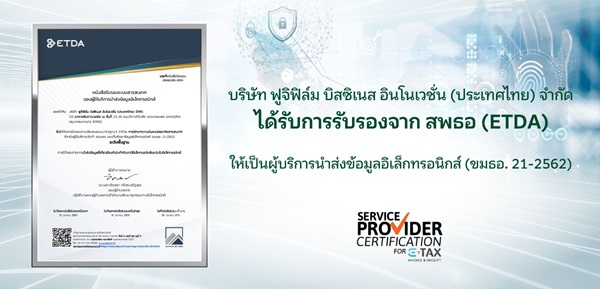

We offer two modes of e-Tax Invoice services:

- Host to Host

- Service Provider

You can choose the service according to your business needs. Our host-to-host service, for example, is ideal for businesses that require high volumes of tax documents to be filed each month. It also comes with administrative services, which will help to provide a level of support to busy organisations with tight tax filing deadlines.

On the other hand, businesses that choose our Service Provider package will be able to benefit from greater flexibility and connectivity thanks to it being hosted on the cloud. Additionally, our charge-per-transaction model also helps to keep business costs low for companies that don’t require high volume filing of e-invoices and e-receipts.

You can choose the service according to the suitability of your business.

Example of Cost compare when using the e-Tax Solution

Send files via e-mail, reducing paper consumption.

No need to waste time preparing accounting documents.

No need for rental of storage spaces.

Send files via e-mail, no need to deliver paper documents.

Apart from e-Tax Solutions, you can also explore our other FUJIFILM Business Innovation services such as our Robotic Process Automation tool, which helps businesses streamline their workflows by automating repetitive tasks. Or discover convenient printing on-the-go with our Cloud On-Demand Print services.

For any queries on our products and services, please contact us via phone call or send us an online contact form.